- CRE Basics Real Estate

- Oct 01

CRE Basics: The Capital Stack

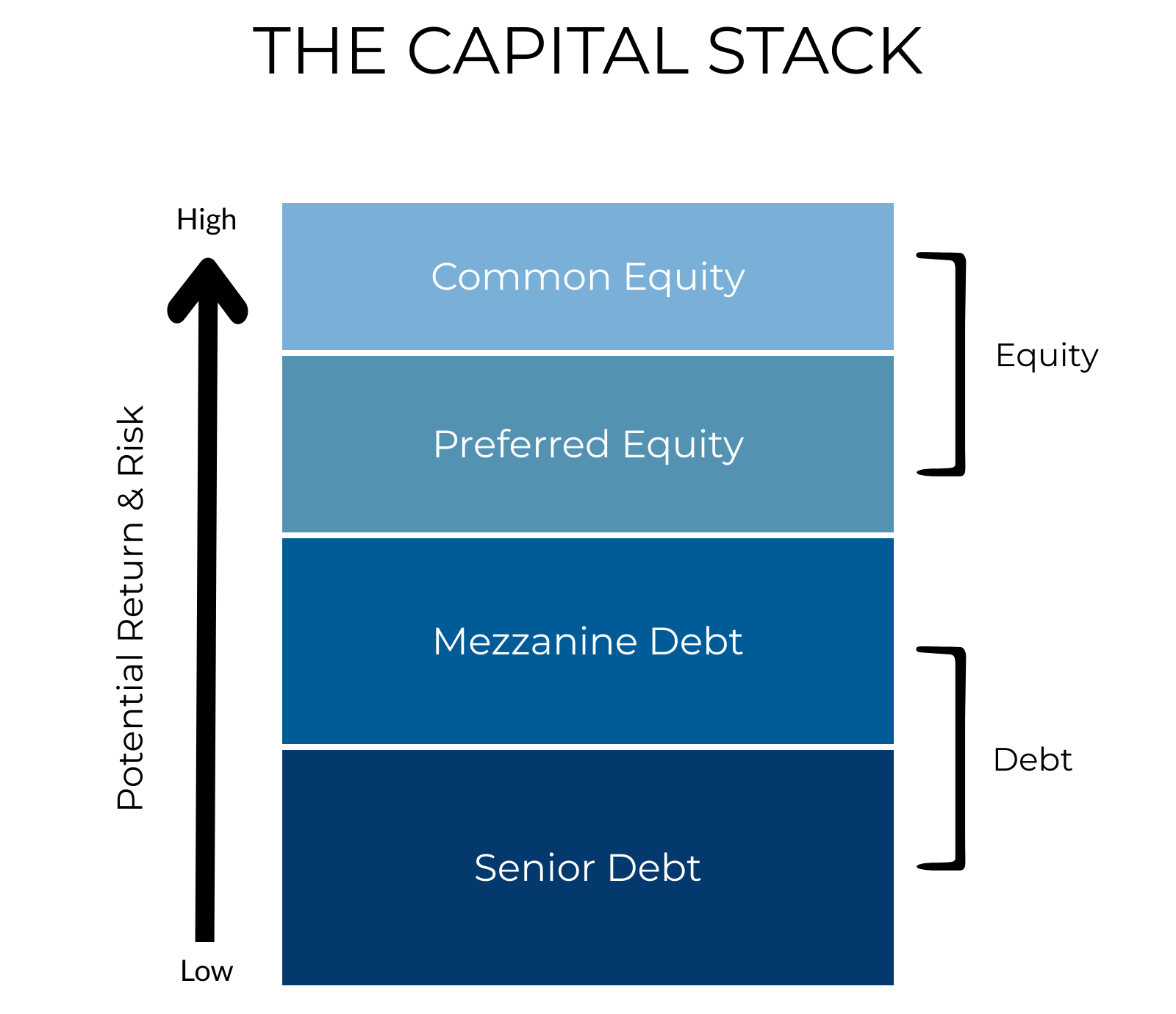

Understanding an investment’s place in the “capital stack” is one of the most critical aspects of due diligence an investor must complete before investing. The “capital stack” refers to the legal organization of all capital placed into a company or secured by an asset through investment or borrowing. In commercial real estate, the capital stack typically consists of 4 funding sources: Senior Debt, Mezzanine Debt, Preferred Equity, and Common Equity. Each source comes with its own collateral, return expectations, and repayment priority. In this article, we will discuss each of the funding sources in detail so you can better understand the risks and rewards associated with each piece of the capital stack.

Capital Stack: Senior Debt

The foundation of the capital stack and typically the majority of the stack is senior debt. Investors in this funding source are more “senior” to everyone above them in the stack and are first in line to be repaid. Senior debt is generally secured by a mortgage or property, which serves as collateral for the loan. Because it is secured by property, it poses the least amount of risk. Senior debt investors receive the lowest return in the capital stack, typically in the 4%-8% range.

Risk Level: Low

Repayment Prioritization: 1st

Return Expectations: 4% – 8%

Capital Stack: Mezzanine Debt

Mezzanine Debt is one of the mechanisms a developer may use to plug the funding gap between senior debt and common equity. As a funding source, it is also debt, but there are two significant differences between it and senior debt. First, mezzanine debt is second in line to be repaid, meaning that the senior debt holders must be repaid in full before any funds are available to the mezzanine debt holders. Second, mezzanine debt is usually not secured by tangible assets (like property) and is instead secured by an interest in the borrowing entity. Mezzanine debt is a higher risk form of debt than senior debt, so the holder demands a higher return on their capital, typically in the 12% – 20% range.

Risk Level: Medium – High

Repayment Prioritization: 2nd

Return Expectations: 12% – 20%

Capital Stack: Preferred Equity

Preferred equity is a debt/equity hybrid that resides in the third position of the capital stack. It is more senior than common equity but less senior than all forms of debt (Senior and Mezzanine).

Preferred equity is very similar to mezzanine debt in many respects. The main difference is that preferred equity is a direct ownership stake in a property, whereas mezzanine financing is a form of debt that can be converted to equity in case the borrower defaults. In many cases, mezzanine debt investors may not be granted equity directly in the property itself, but in the entity that owns the property. Sometimes, this makes things slightly more complex from a financial standpoint.

Investors who make a preferred equity investment are compensated with a steady return in the form of annual payments. They also have the opportunity to participate in the upside of the project should it meet specific performance goals. The performance goals are clearly outlined in the investment contract and typically establish a threshold, above which an equity “kicker” allows the preferred equity holder to participate in additional profits.

Returns for a preferred equity investment are typically in the 7% – 15% range and may go higher with equity participation.

Risk Level: Medium – High

Repayment Prioritization: 3rd

Return Expectations: 8% – 10% + “Kicker”

Capital Stack: Common Equity

Common equity holders are at the top of the capital stack. This funding source contains the most risk in the capital stack, but it’s also potentially the most profitable.

When an investor invests in common equity of a project, they are taking an ownership stake in the project. As part of their agreement to finance a project, a lender will require that the Borrower (or General Partner) invest their own money to ensure they have a vested interest in the success of the project. Common equity investors are only repaid after all of the other positions in the capital stack are repaid.

In return for being last in line, the common equity investor is compensated with virtually unlimited upside. Because the return potential is excellent, and the funds are their own, the common equity investor has a significant vested interest in the success of the project.

Risk Level: High

Repayment Prioritization: 4th

Return Expectations: 10%+

Conclusion

Commercial real estate offers a wide variety of investment strategies that allow investors to select a place in the capital stack that meets their risk appetite. Understanding the risks and rewards of each layer in the capital stack is the first step in creating an investment portfolio that meets your long-term goals. Knowing your position in the capital stack is essential to growing and protecting your wealth.