- Opportunity Zones Real Estate

- Mar 13

- 5 mins read

Opportunity Zone Program – What Investors Need to Know

The Opportunity Zone program, created by the Tax Cuts and Jobs Act (TCJA) of 2017, was designed to encourage economic growth in low-income urban and rural communities throughout the nation by providing tax benefits to investors.

“We want all Americans to experience the dynamic opportunities being generated by President Trump’s economic policies. We anticipate that $100 billion in private capital will be dedicated towards creating jobs and economic development in Opportunity Zones,” said Secretary Steven T. Mnuchin. “This incentive will foster economic revitalization and promote sustainable economic growth, which was a major goal of the Tax Cuts and Jobs Act.”

“Opportunity Zones” is a relatively new term, and many investors don’t know what they, or how to use them to their benefit. If you’re considering investing in Opportunity Zones, it’s important to understand what they are and whether this is the right program for you.

What are Opportunity Zones?

Opportunity Zones are low-income census tracts nominated by governors and certified by the U.S. Department of the Treasury into which investors can now put capital to work financing new projects and enterprises in exchange for certain federal capital gains tax advantages. Opportunity Zones have been designated in all 50 states, the District of Columbia and five U.S. territories. These designations stay in place for ten years and cannot be modified. More than 8,700 communities are designated as qualified opportunity zones in the US and US territories. To receive access to capital gain tax incentives, investors can invest in Qualified Opportunity Zones through Opportunity Funds.

Opportunity Zone Map

Here is the national map of Qualified Opportunity Zones certified by the Department of the Treasury on June 14, 2018.

Map Source: EIG.org Web Map by: CVaillancourt_EsriMedia

How The Program Works

The designation of Opportunity Zones is designed to help drive the development of economically distressed communities. In exchange for investing in Opportunity Zones, investors can access capital gains tax incentives available exclusively through the Opportunity Zone program.

To acquire these tax benefits, investors must invest in Opportunity Zones specifically through Opportunity Funds. Opportunity Funds are a new class of investment vehicles (organized as a corporation or a partnership) that specialize in aggregating private investment and deploying that capital in Opportunity Zones to support Opportunity Zone Property. A qualified Opportunity Fund is a US partnership or corporation that intends to invest at least 90% of its holdings in one or more qualified Opportunity Zones.

Because the Opportunity Zone program is intended to stimulate positive growth within these designated communities, there are restrictions on the types of investments in which an Opportunity Fund can invest. These investments are called “Qualified Opportunity Zone Property.”

What is a Qualified Opportunity Zone Property?

Qualified Opportunity Zone Property is used to refer to property that is qualified opportunity zone stock, a qualified opportunity zone partnership interest, or a qualified opportunity zone business property acquired after December 31, 2017, used in a trade or business conducted in a Qualified Opportunity Zone or ownership interest in an entity (stock and partnership interests) operating with such tangible property.

Ideally, the Opportunity Zone Fund must bring property new to the entity to be used in the Opportunity Zone. A fund that acquires property already being used in the zone will not qualify without substantial improvement. Substantial improvement requires improvements equal to the Opportunity Zone Fund’s initial investment into the existing property over a 30-month period.

For example, if an Opportunity Zone Fund acquires existing property in an Opportunity Zone for $1 million, the fund has 30 months to invest an additional $1 million for improvements to that property to qualify for this program.

Opportunity Funds are governed by IRC section 1400Z-2, and Opportunity Funds can self-certify to the IRS. However, each Opportunity Fund is responsible for ensuring that they abide by the guidelines of the Opportunity Program to be able to offer tax incentives.

What are the Tax Incentives for Investing in Opportunity Zones?

Opportunity Zones are designed to incentivize new equity investments in low-income communities nationwide. All of the underlying incentives relate to the tax treatment of capital gains, and all are tied to the longevity of an investor’s stake in a qualified Opportunity Fund. There are three core tax incentives:

Temporary deferral: A temporary deferral of inclusion in taxable income for capital gains reinvested into an Opportunity Fund. The deferred gain must be recognized on the earlier of the date on which the Opportunity Zone investment is disposed of or December 31, 2026.

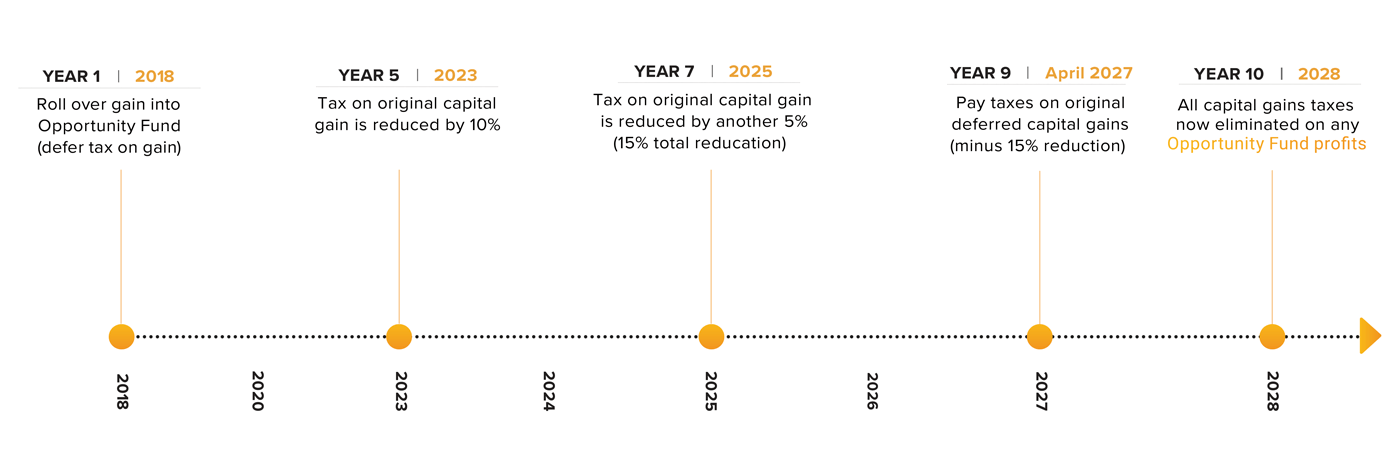

Step-up in basis: A step-up in basis for the deferred capital gains reinvested in an Opportunity Fund. The basis is increased by 10% if the taxpayer holds the investment in the Opportunity Fund for at least five years and by an additional 5% if held for at least seven years, thereby excluding up to 15% of the original deferred gain from taxation.

Permanent exclusion: A permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund if the investment is held for at least ten years. This exclusion only applies to gains accrued on investments made through an Opportunity Fund. There is no permanent exclusion possible for the initially deferred gain.

As you can see, there is a timeline that investors must follow to maximize the tax advantages available through the Opportunity Zone program. For those who invested in 2018, here is a timeline of benefits that they can expect to receive:

For a thorough overview and analysis of the benefits of Opportunity Zones investment, see EIG’s Opportunity Zones Fact Sheet.

Putting it All Together

Ultimately, with the creation of the Opportunity Zone program, investors can transform thousands of economically distressed communities while gaining access to capital gain incentives if they stay within the guidelines of the Opportunity Zone Program. CrowdEngine offers an easy way for you to start utilizing crowdfunding portals as a way to group investors within a single fund to participate in the opportunity zones. Issuers that are creating an Opportunity Fund can use our white label or private label solution to create offerings such as a Reg D 506(c) for accredited investors or an A+ raise for both accredited and non-accredited investors. With our white label or private label solutions, you can manage investors, track investments, track returns, and even disperse earnings. Contact us to learn more!

Disclaimer: This information is provided to our clients and other friends for educational purposes only. CrowdEngine is not guaranteeing any information as reliable or accurate, and that it’s subject to change at any time. It should not be construed or relied upon as legal advice. Please contact your accountant and or lawyer with respect to any of the matters discussed here.

This post was written by Lanli Pham on March 18, 2019